Moyoli

Moyoli

Moyoli

A savings app designed to make personal finance feel friendly, intuitive, and rewarding. Guided by Moyo, a customizable axolotl companion, users can set multiple savings goals, visually track their progress, and build healthier financial habits through gentle motivation and meaningful rewards. By blending gamification with emotional design, Moyoli transforms saving money into a supportive journey rather than a stressful task.

A savings app designed to make personal finance feel friendly, intuitive, and rewarding. Guided by Moyo, a customizable axolotl companion, users can set multiple savings goals, visually track their progress, and build healthier financial habits through gentle motivation and meaningful rewards. By blending gamification with emotional design, Moyoli transforms saving money into a supportive journey rather than a stressful task.

A savings app designed to make personal finance feel friendly, intuitive, and rewarding. Guided by Moyo, a customizable axolotl companion, users can set multiple savings goals, visually track their progress, and build healthier financial habits through gentle motivation and meaningful rewards. By blending gamification with emotional design, Moyoli transforms saving money into a supportive journey rather than a stressful task.

My Role

UX Design, Wireframing, Prototyping, User Flow

My Role

UX Design, Wireframing, Prototyping, User Flow

My Role

UX Design, Wireframing, Prototyping, User Flow

Team

- Paulina E. Cavazos Robles

Team

- Paulina E. Cavazos Robles

Team

- Paulina E. Cavazos Robles

Timeline

November 2023

(3.5 weeks)

Timeline

November 2023

(3.5 weeks)

Timeline

November 2023

(3.5 weeks)

Tools

Figma, Adobe Illustrator

Tools

Figma, Adobe Illustrator

Tools

Figma, Adobe Illustrator

PROBLEM STATEMENT

PROBLEM STATEMENT

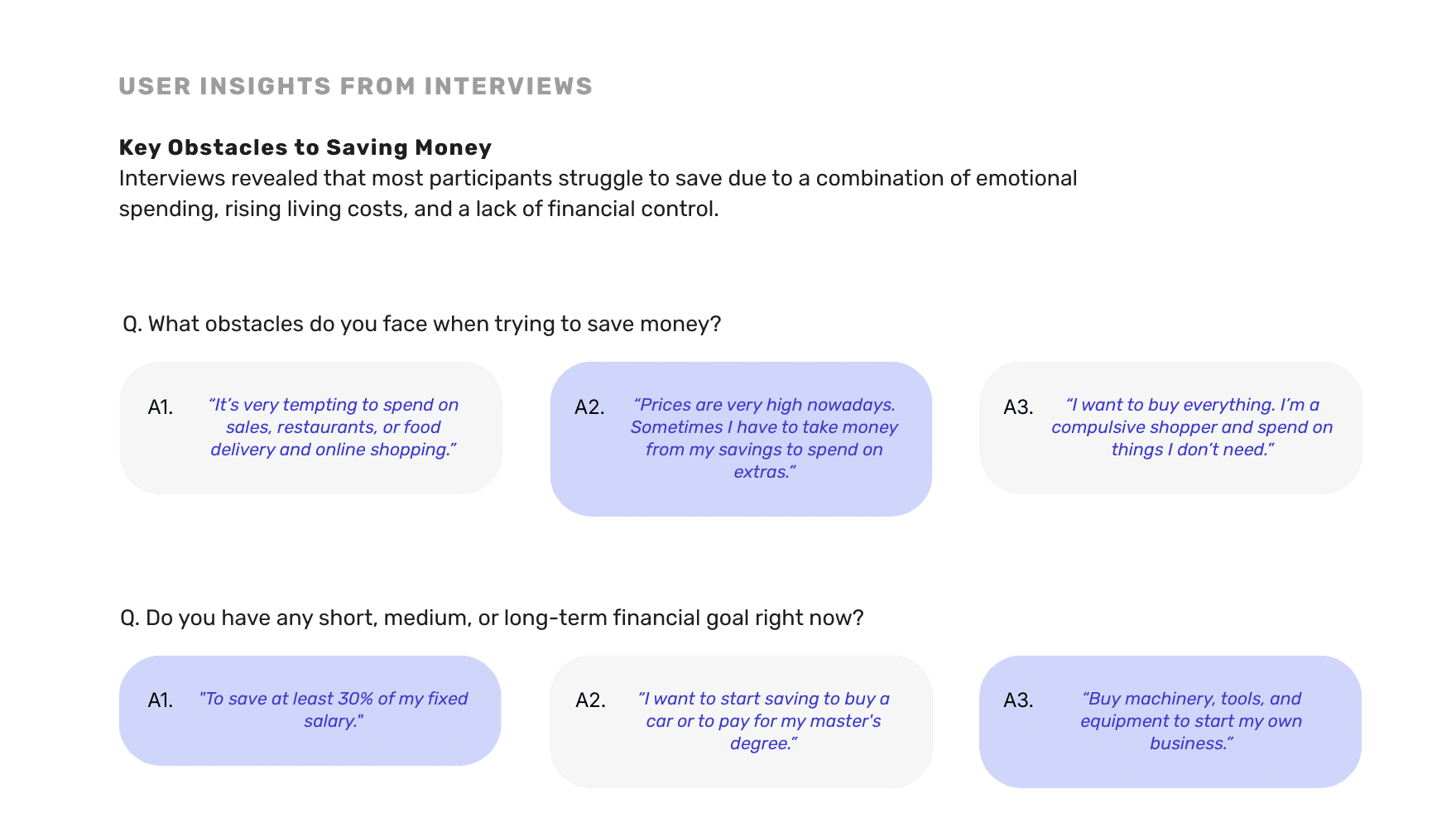

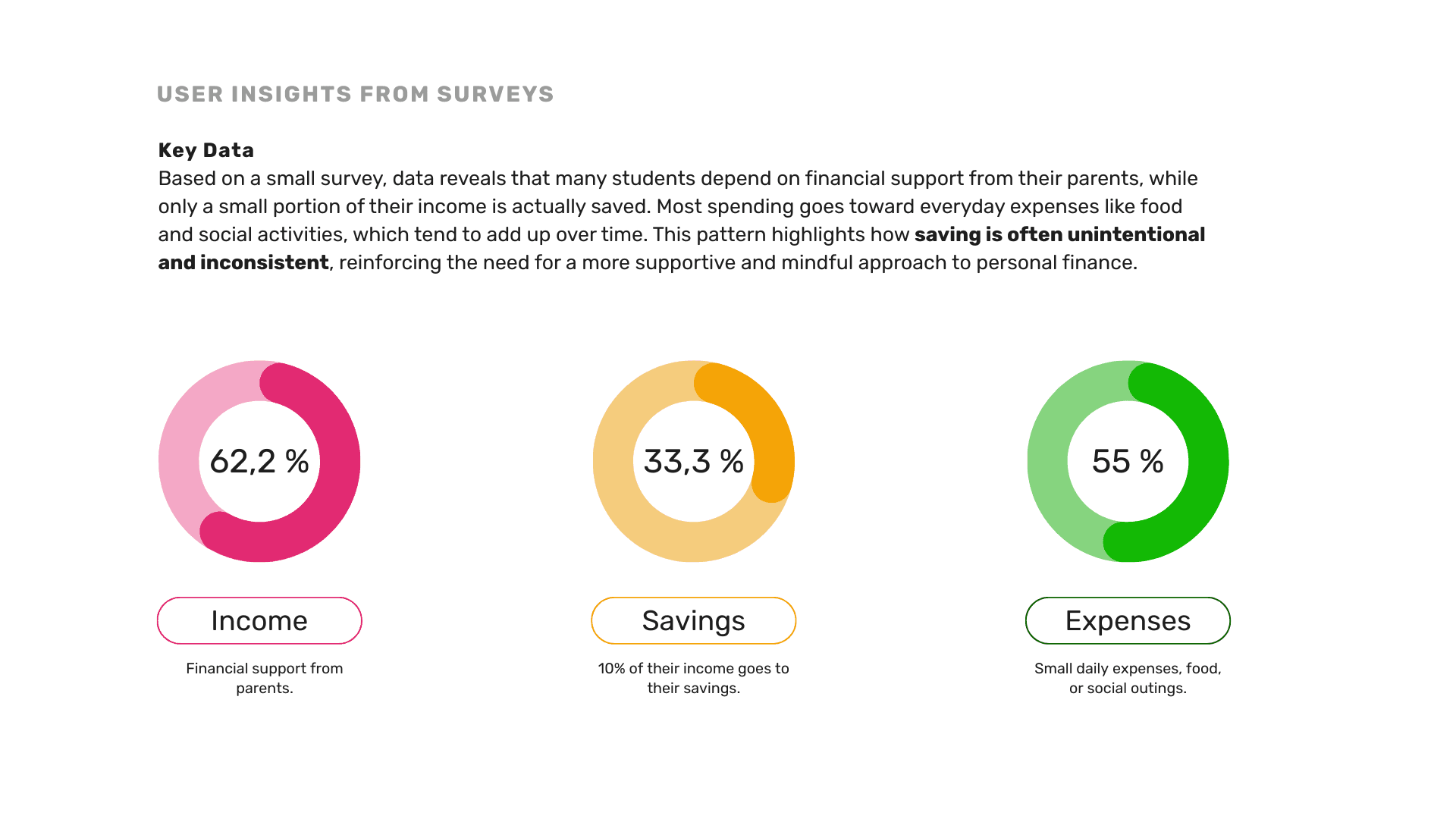

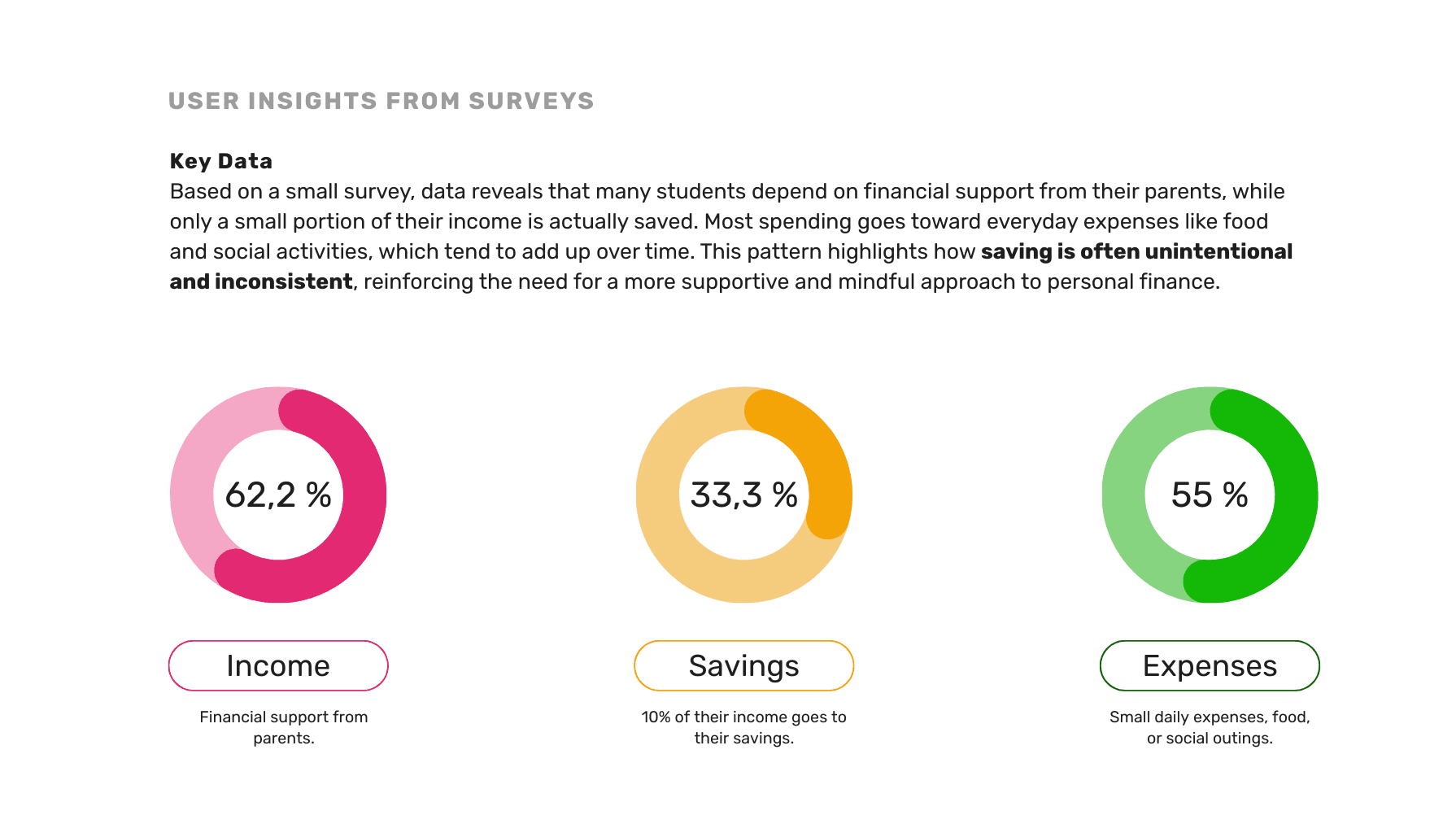

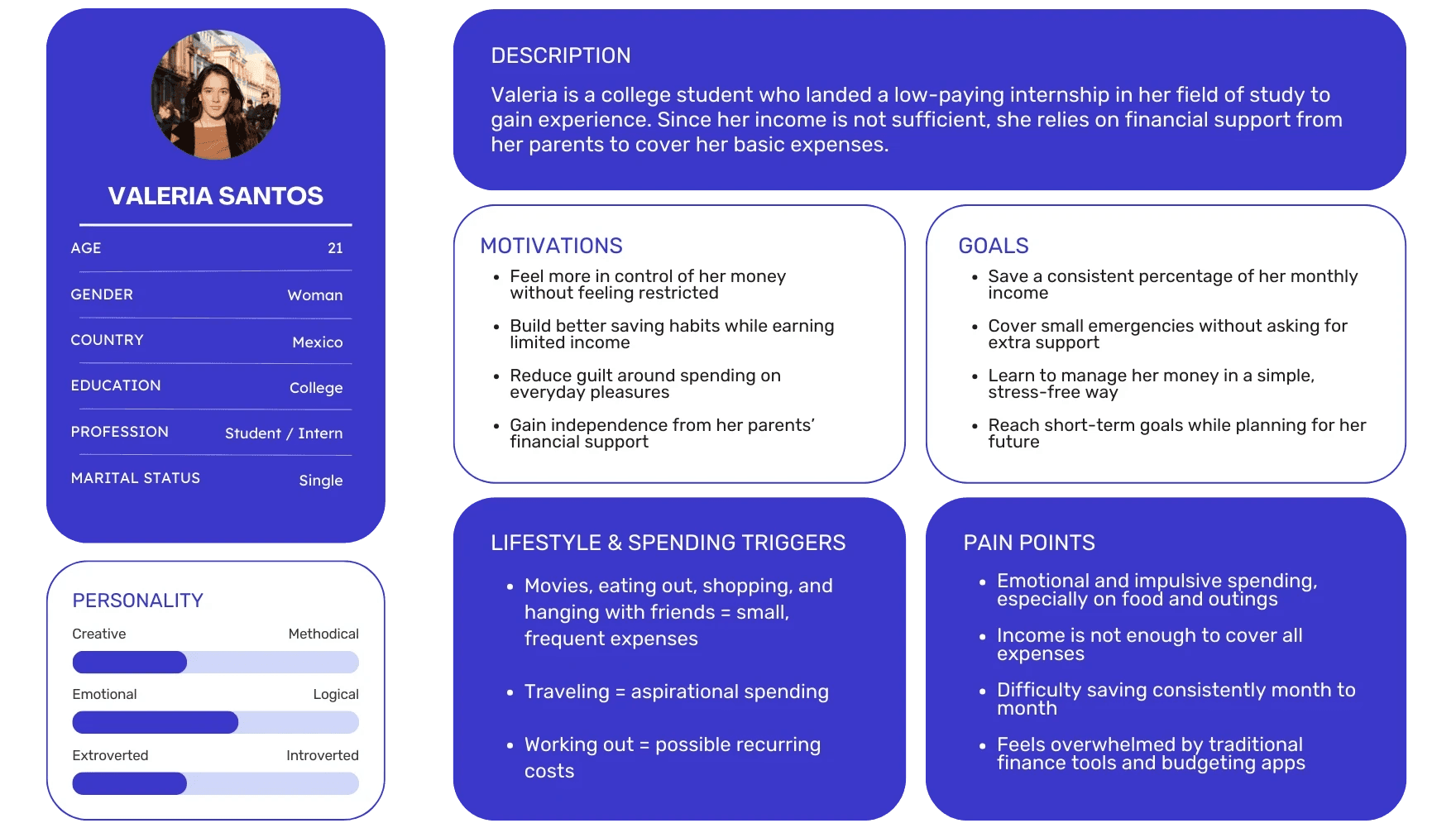

Young adults and students struggle to save money consistently due to emotional spending, rising living costs, and a lack of financial control. Although they have clear financial goals, saving often feels overwhelming and inconsistent, as most income is absorbed by everyday expenses. This turns saving into a stressful task rather than a supportive habit.

Young adults and students struggle to save money consistently due to emotional spending, rising living costs, and a lack of financial control. Although they have clear financial goals, saving often feels overwhelming and inconsistent, as most income is absorbed by everyday expenses. This turns saving into a stressful task rather than a supportive habit.

Young adults and students struggle to save money consistently due to emotional spending, rising living costs, and a lack of financial control. Although they have clear financial goals, saving often feels overwhelming and inconsistent, as most income is absorbed by everyday expenses. This turns saving into a stressful task rather than a supportive habit.

SOLUTION

SOLUTION

Moyoli reframes saving money as a friendly and motivating experience. Through a customizable axolotl companion, visual progress tracking, and gentle rewards, the app helps users build mindful saving habits without pressure. By combining emotional design and gamification, Moyoli transforms personal finance into an intuitive, encouraging journey.

Moyoli reframes saving money as a friendly and motivating experience. Through a customizable axolotl companion, visual progress tracking, and gentle rewards, the app helps users build mindful saving habits without pressure. By combining emotional design and gamification, Moyoli transforms personal finance into an intuitive, encouraging journey.

Moyoli reframes saving money as a friendly and motivating experience. Through a customizable axolotl companion, visual progress tracking, and gentle rewards, the app helps users build mindful saving habits without pressure. By combining emotional design and gamification, Moyoli transforms personal finance into an intuitive, encouraging journey.

PROJECT OBJECTIVES

PROJECT OBJECTIVES

Encourage consistent saving habits through emotional design and positive reinforcement.

Help users become more mindful of their spending and financial decisions.

Make personal finance feel accessible, friendly, and non-intimidating.

Reduce the stress and guilt associated with saving money by reframing it as a supportive journey.

Use gamification to motivate users without creating pressure or competition.

USER RESEARCH

USER RESEARCH

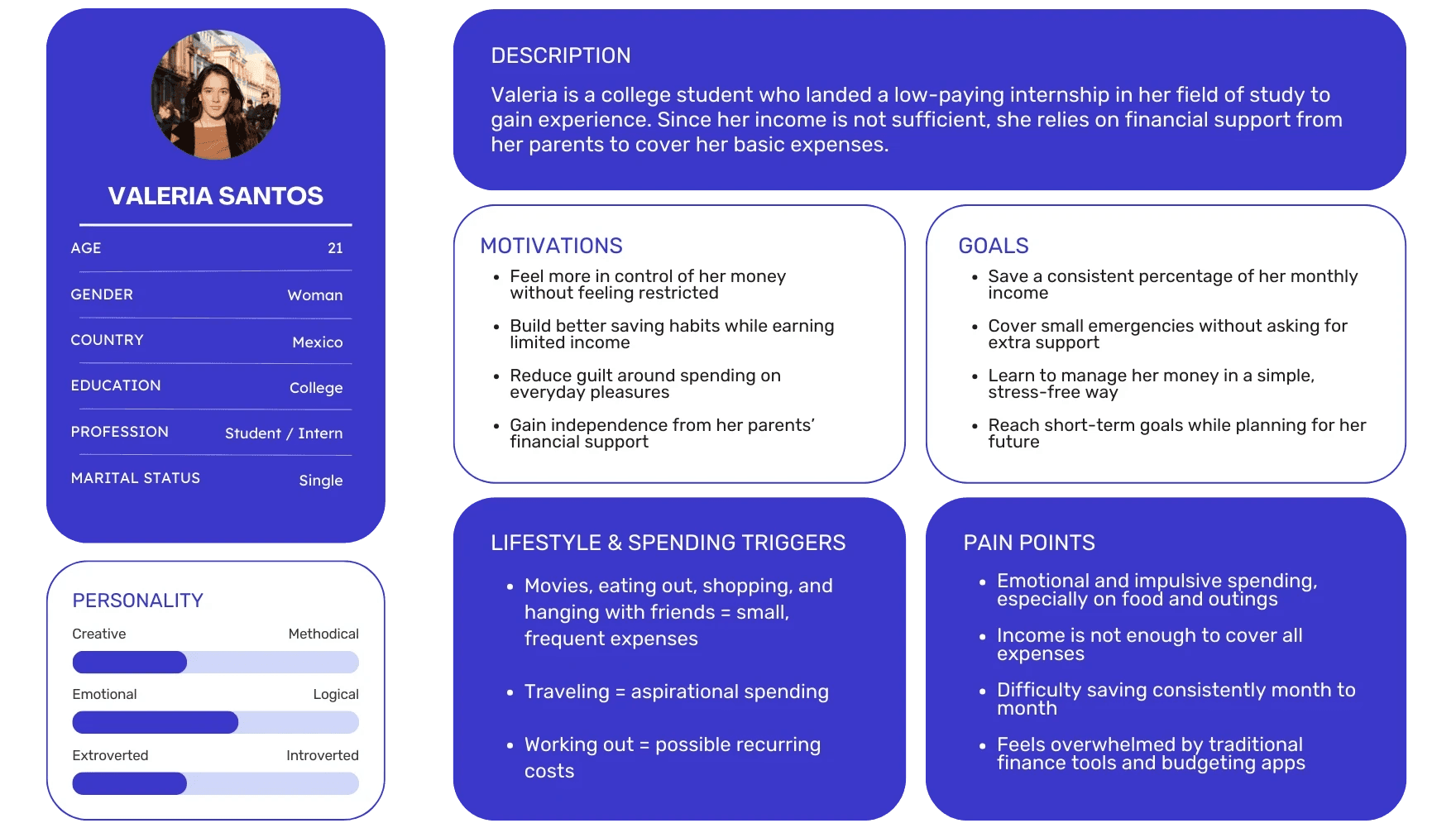

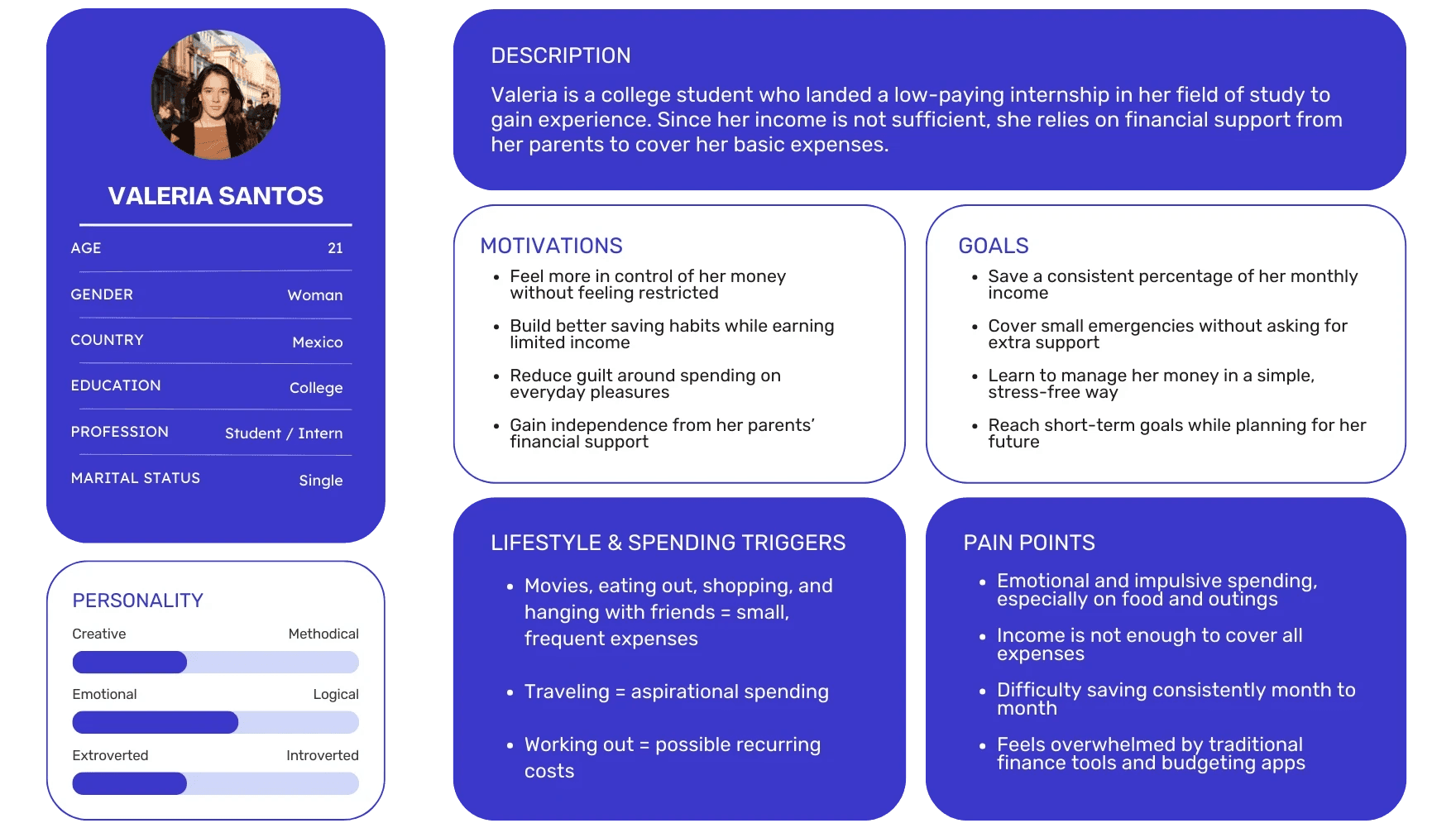

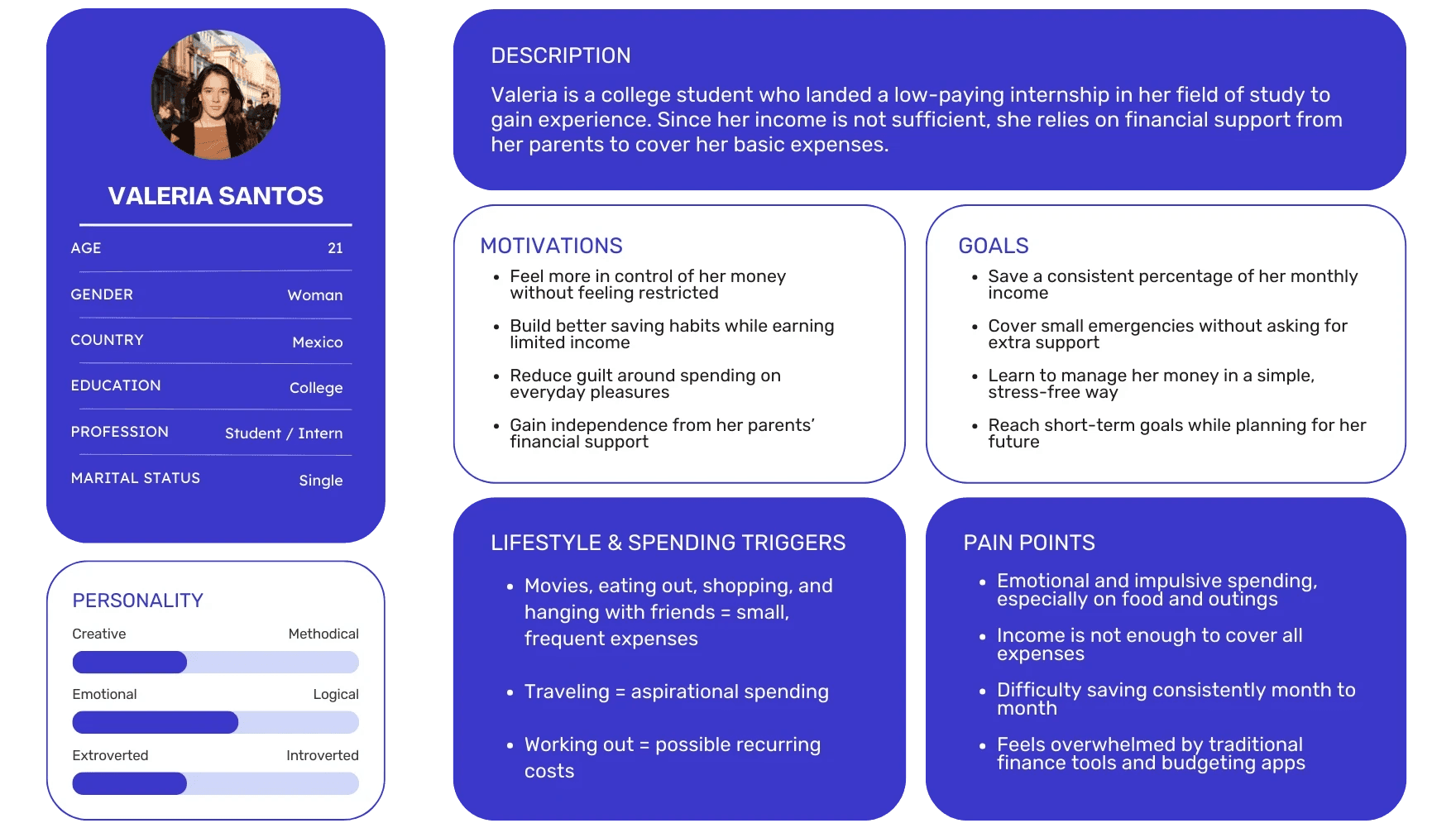

USER PERSONA

USER PERSONA

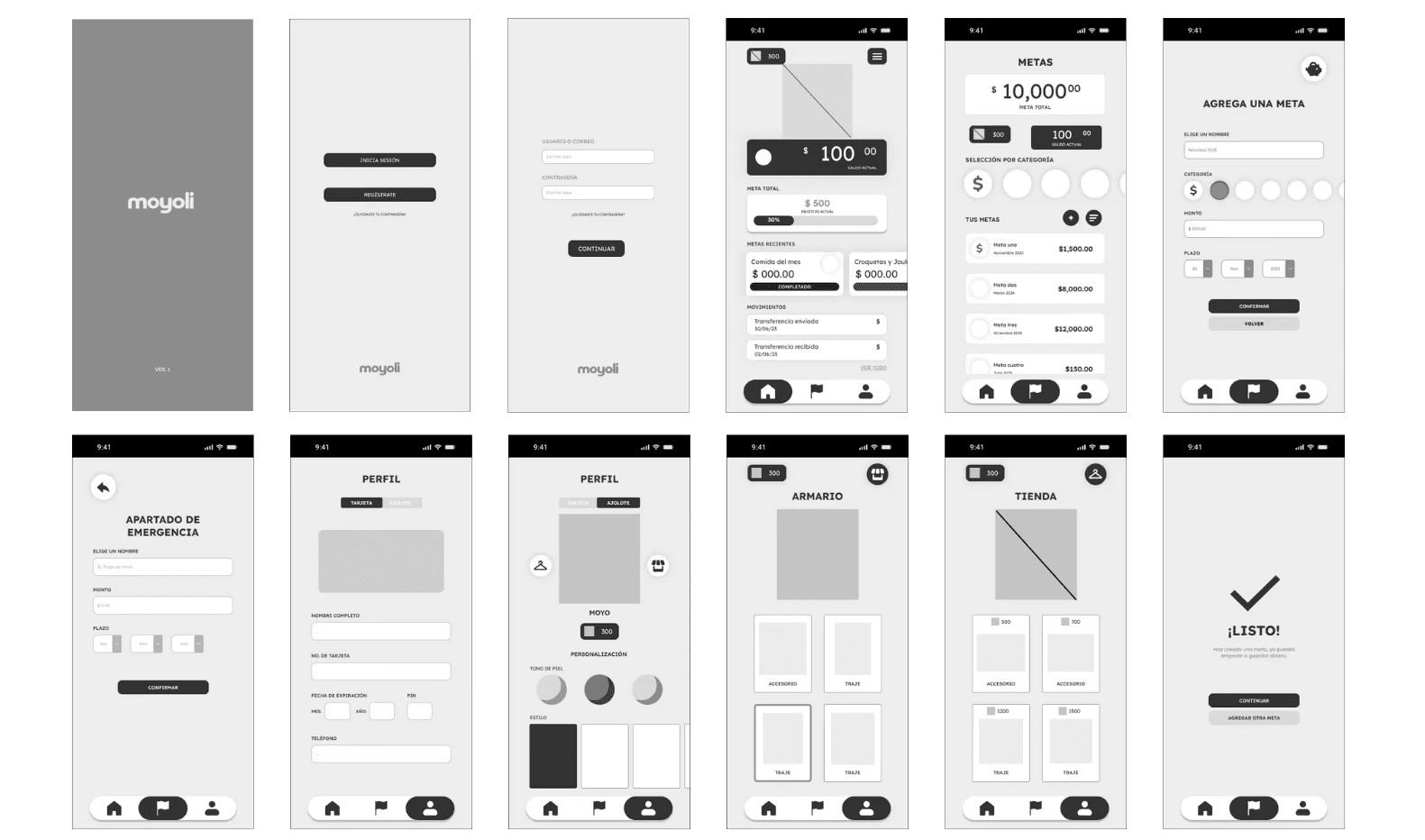

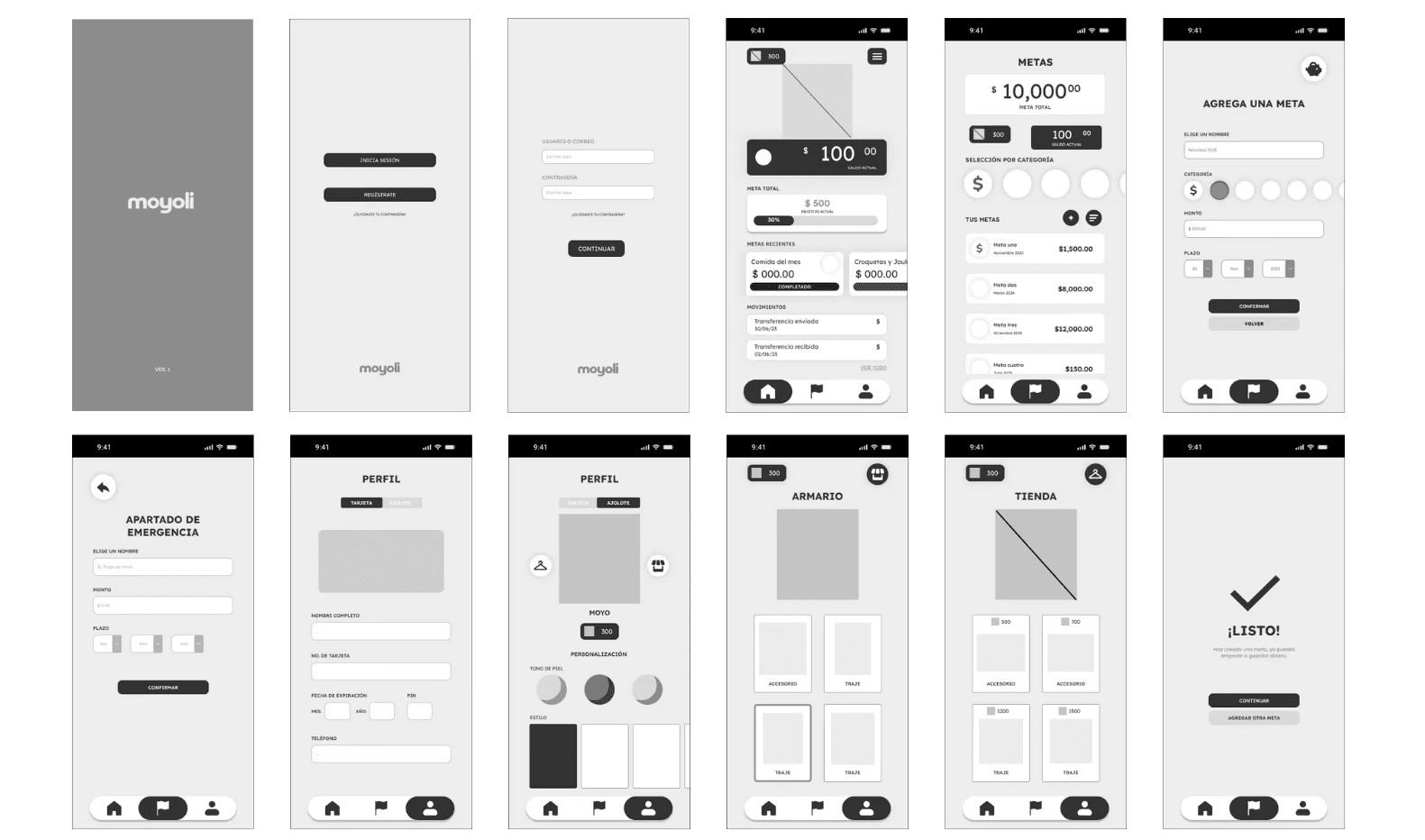

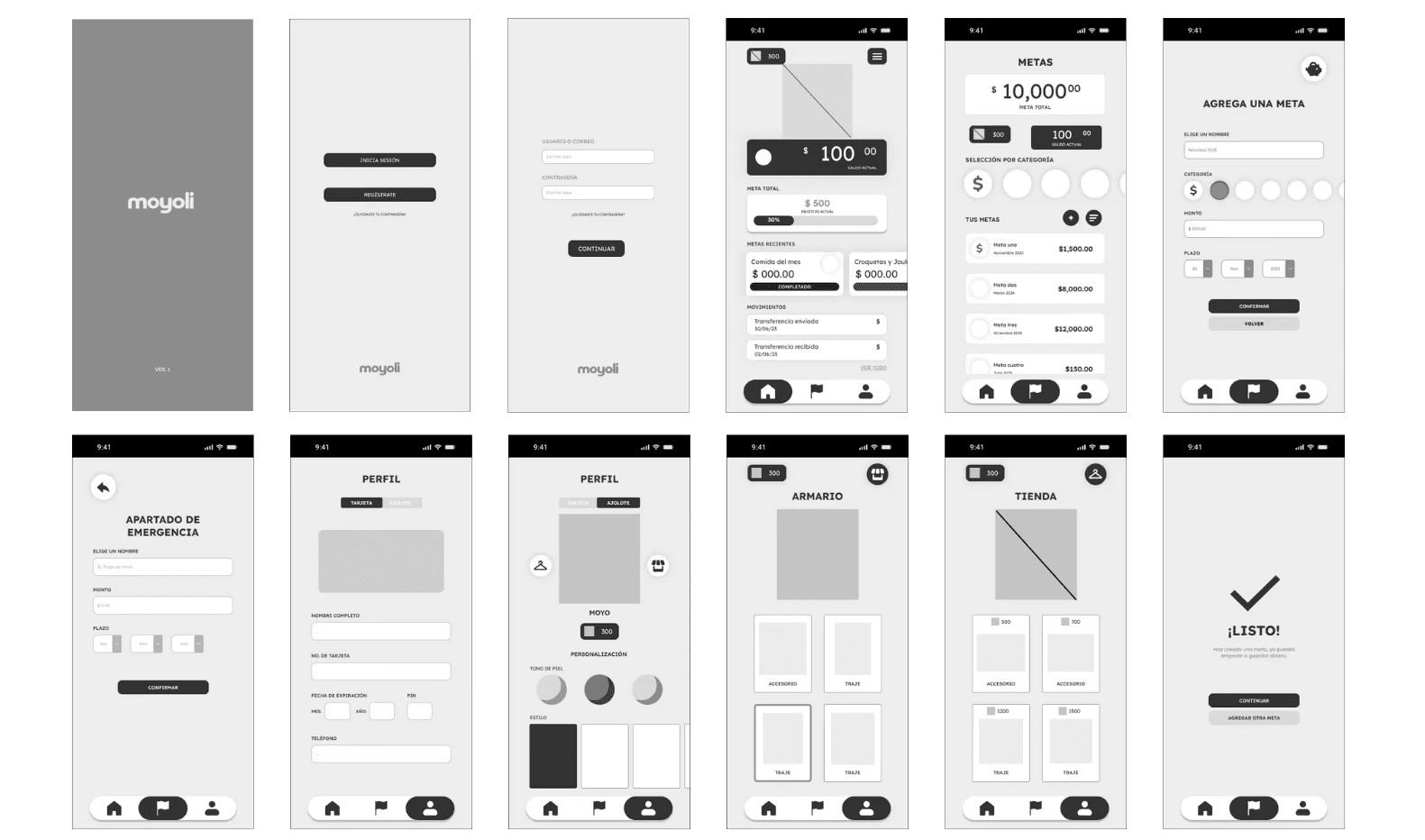

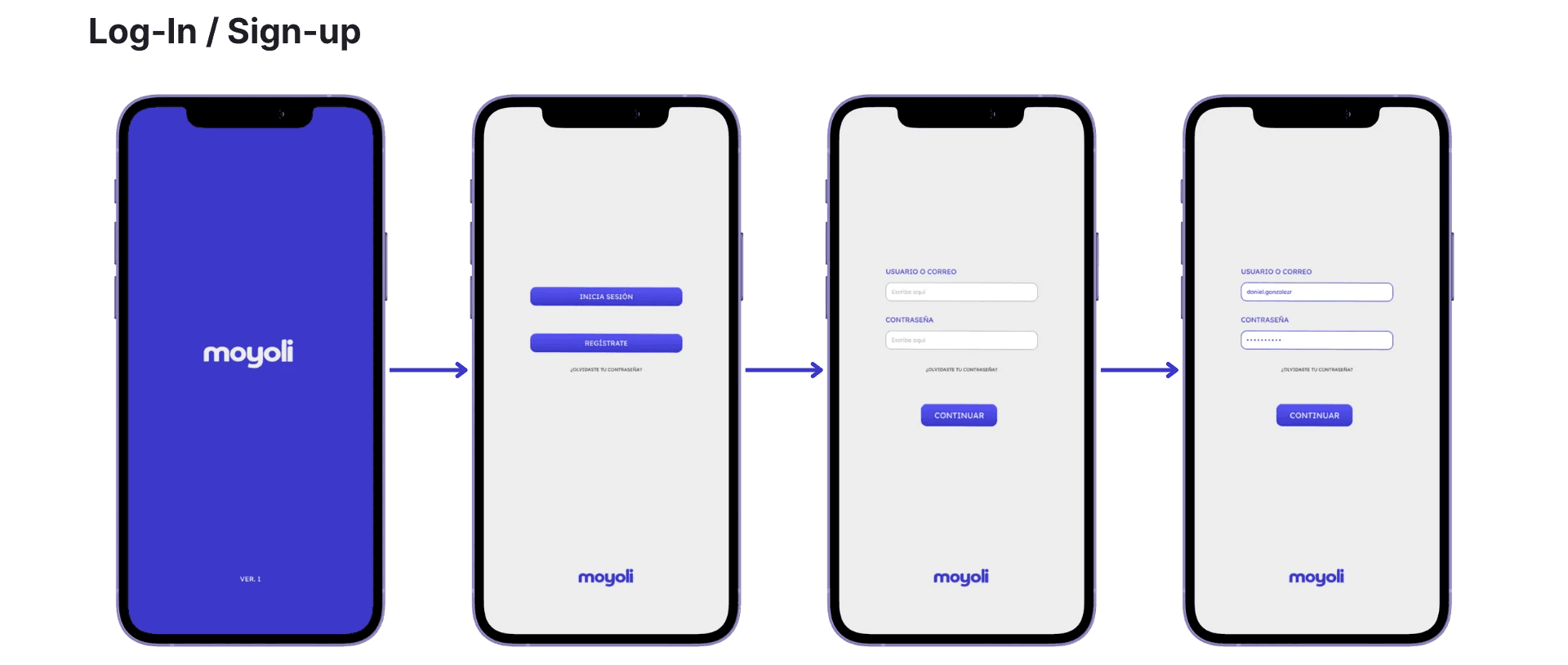

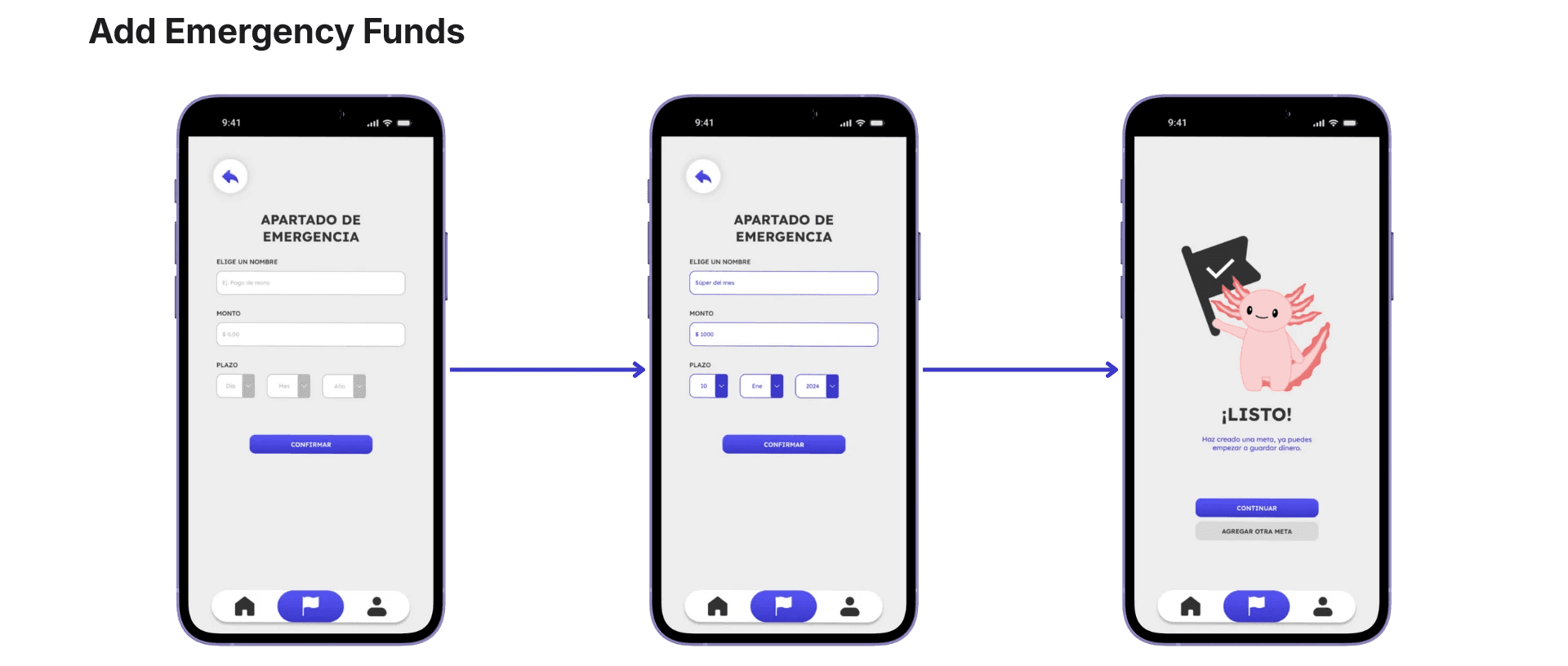

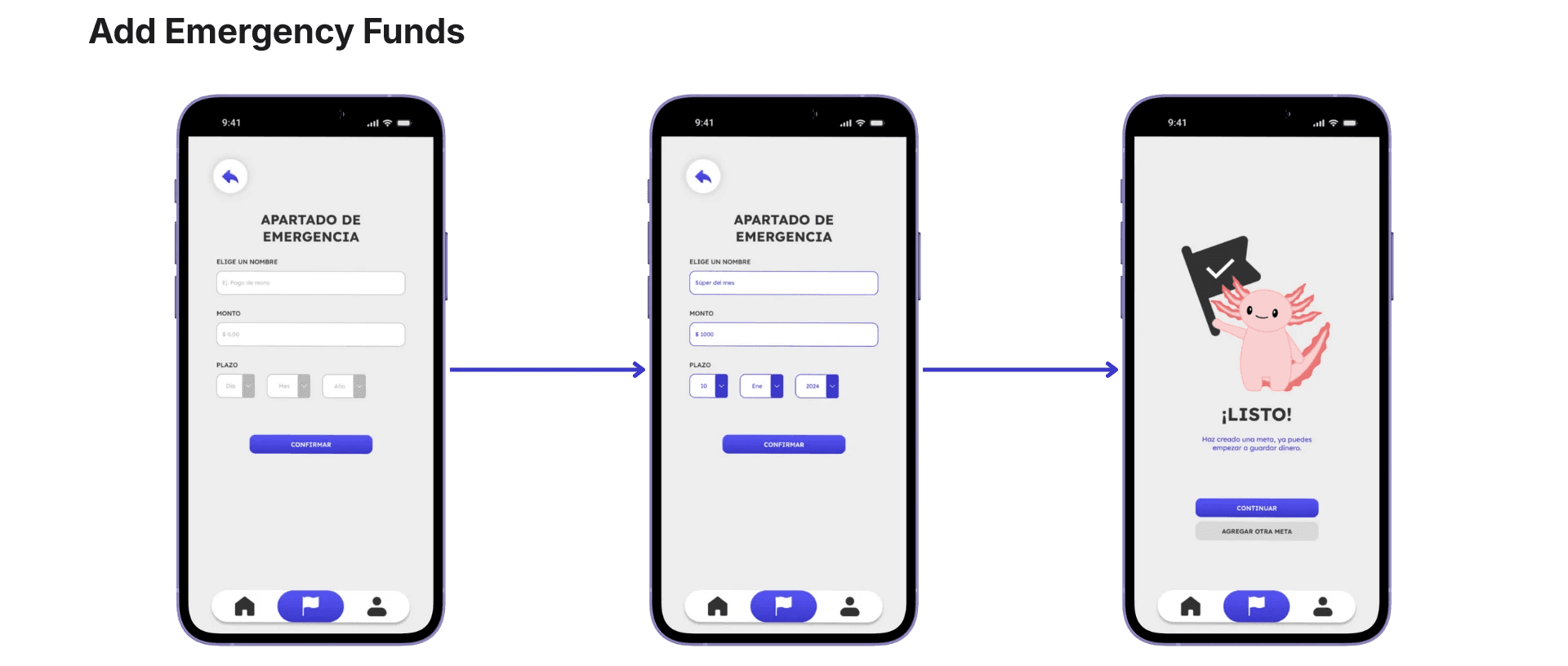

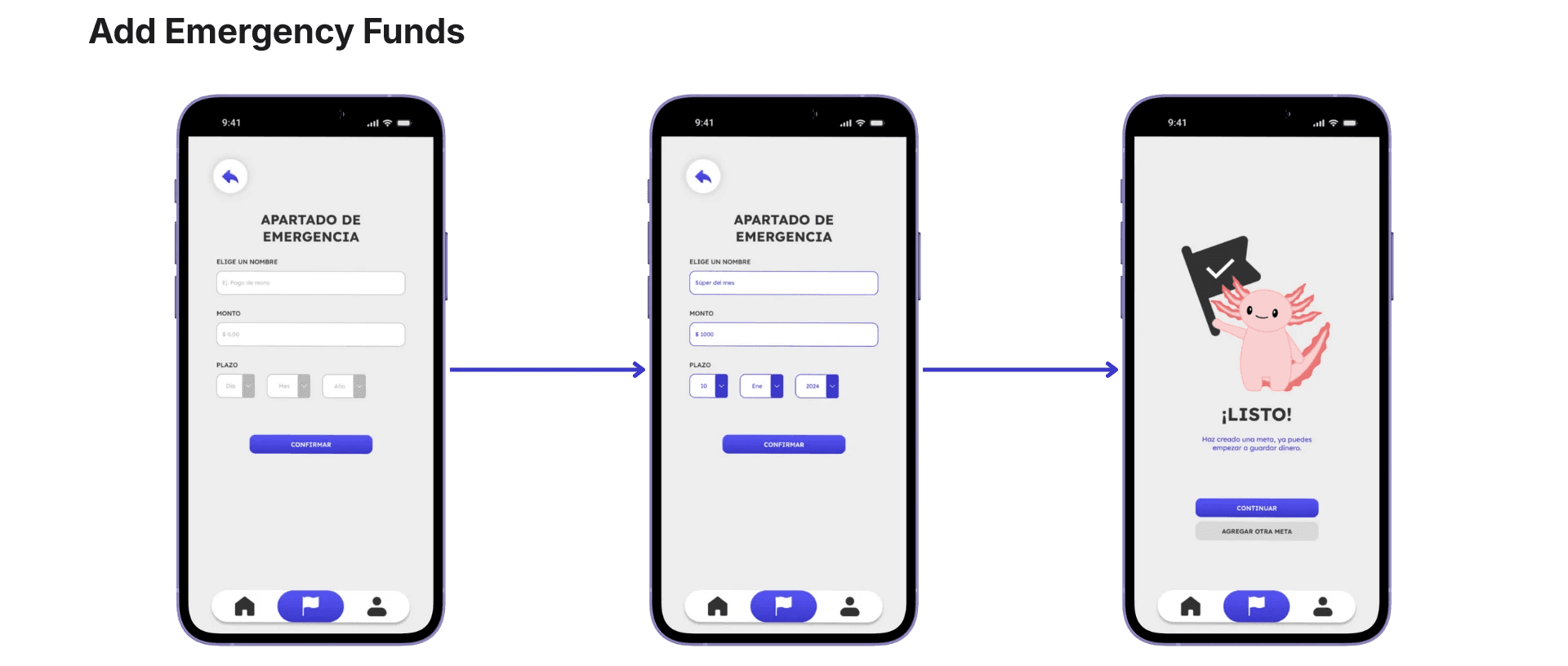

LOW / MID FIDELITY DESIGNS

LOW / MID FIDELITY DESIGNS

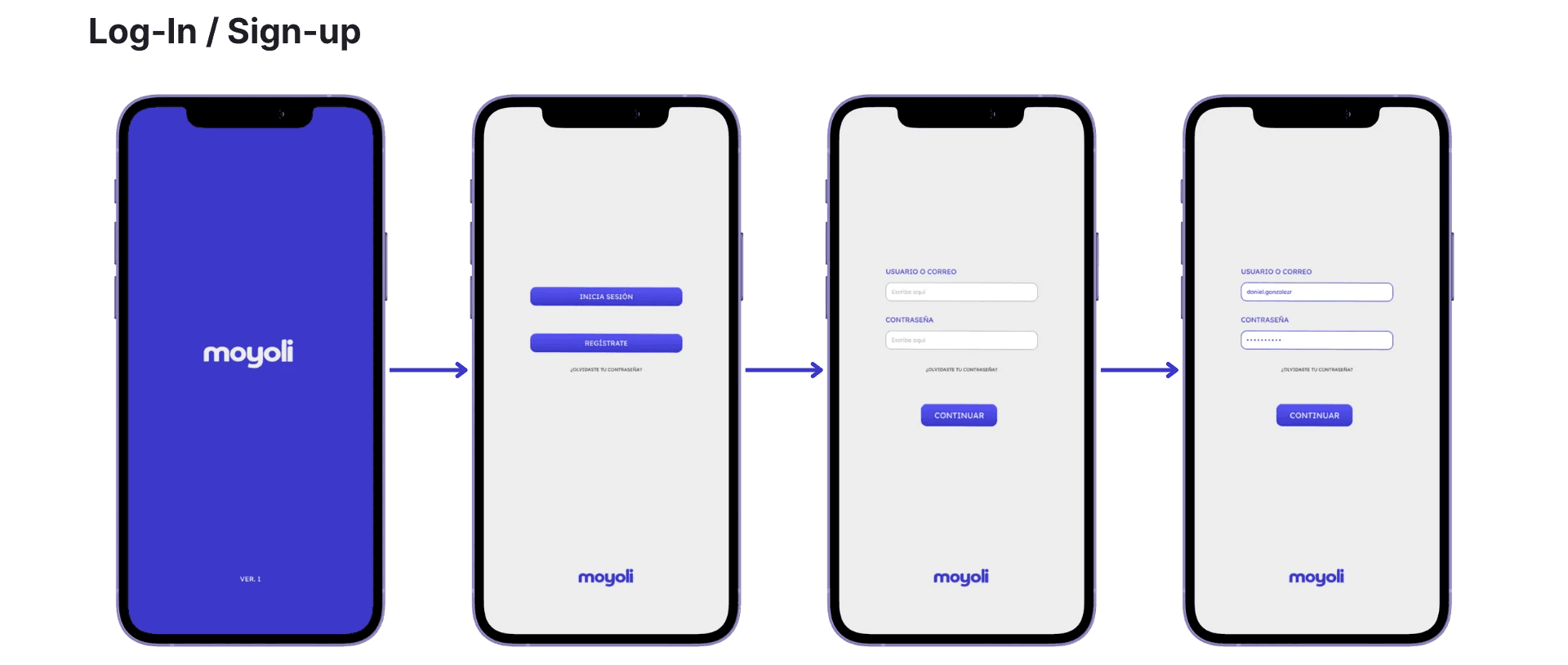

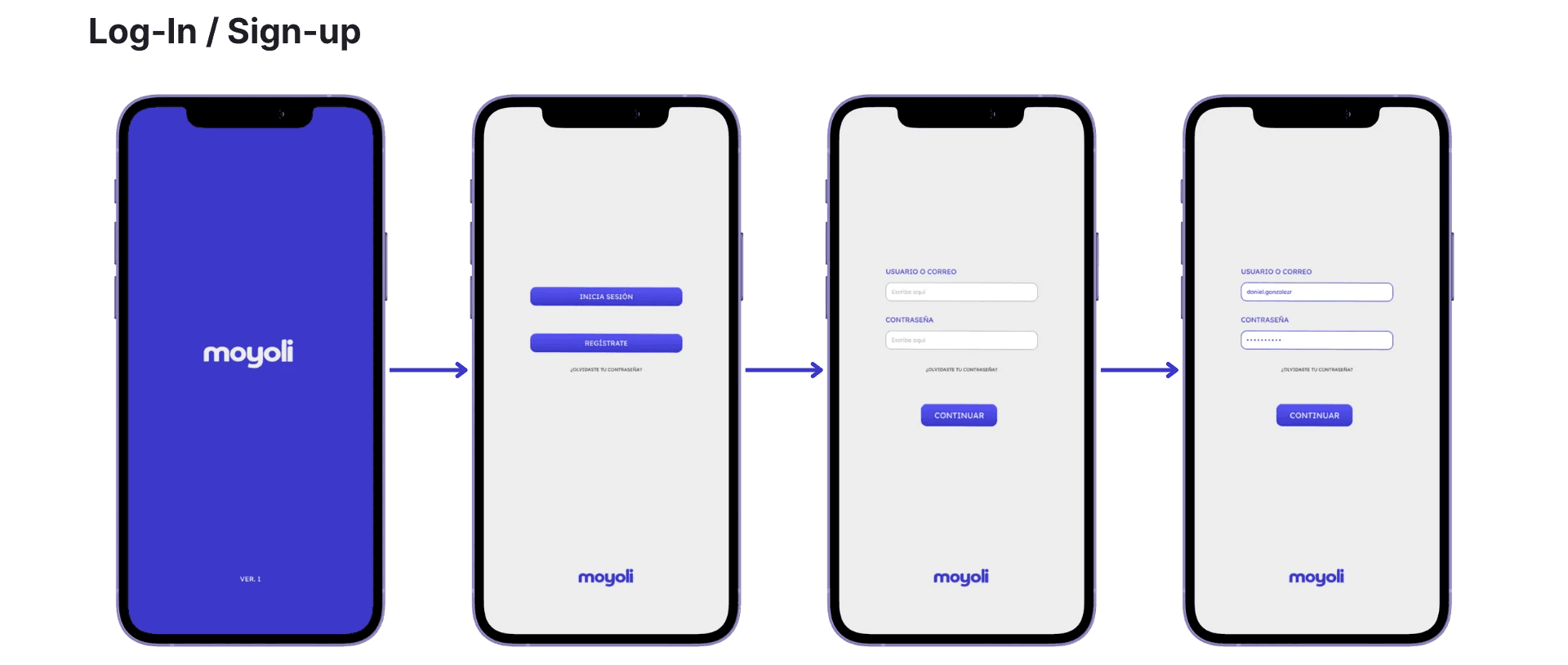

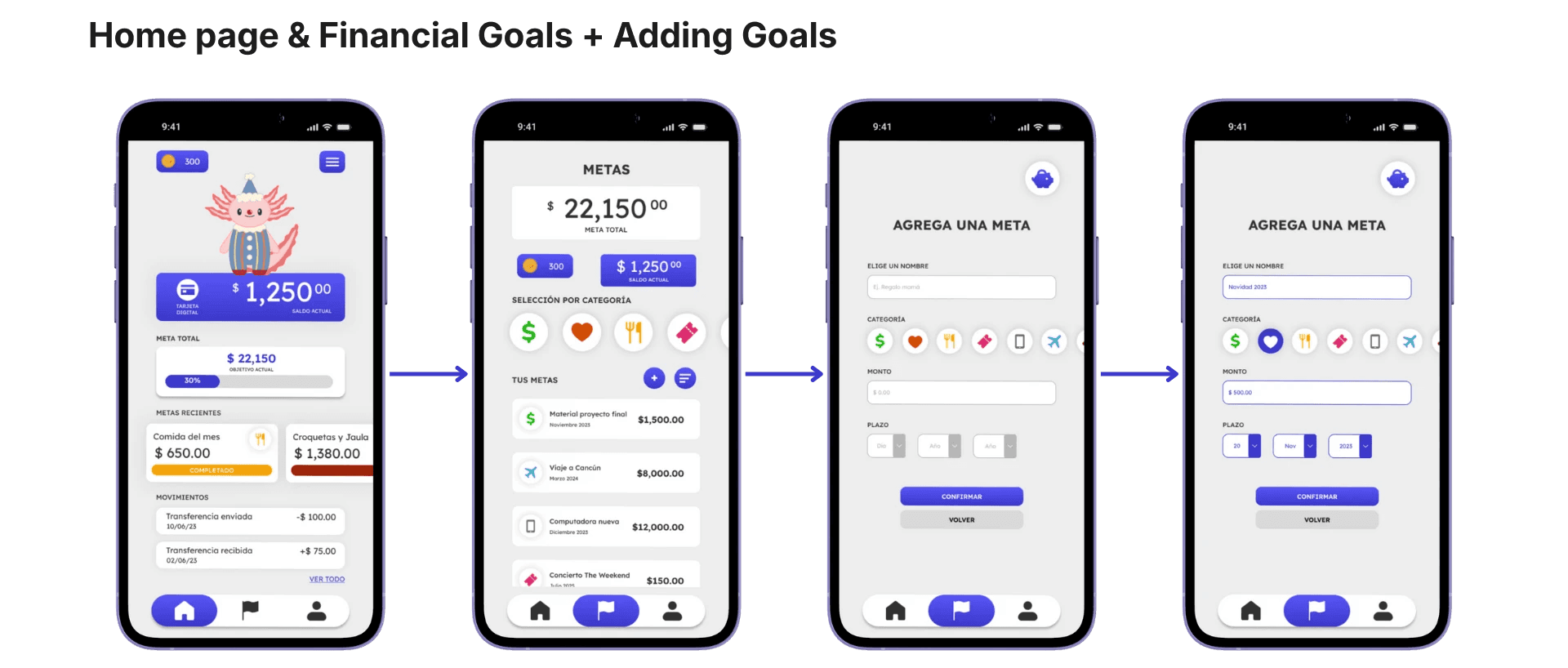

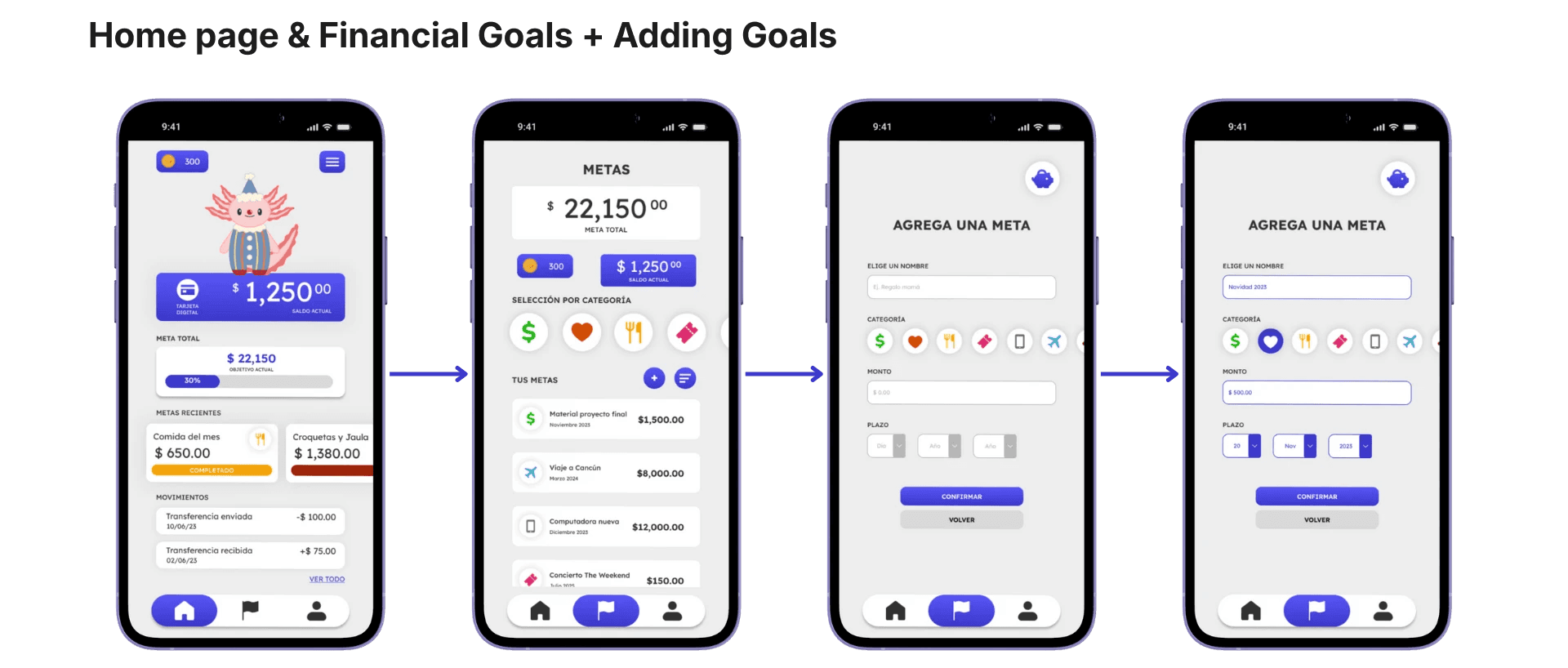

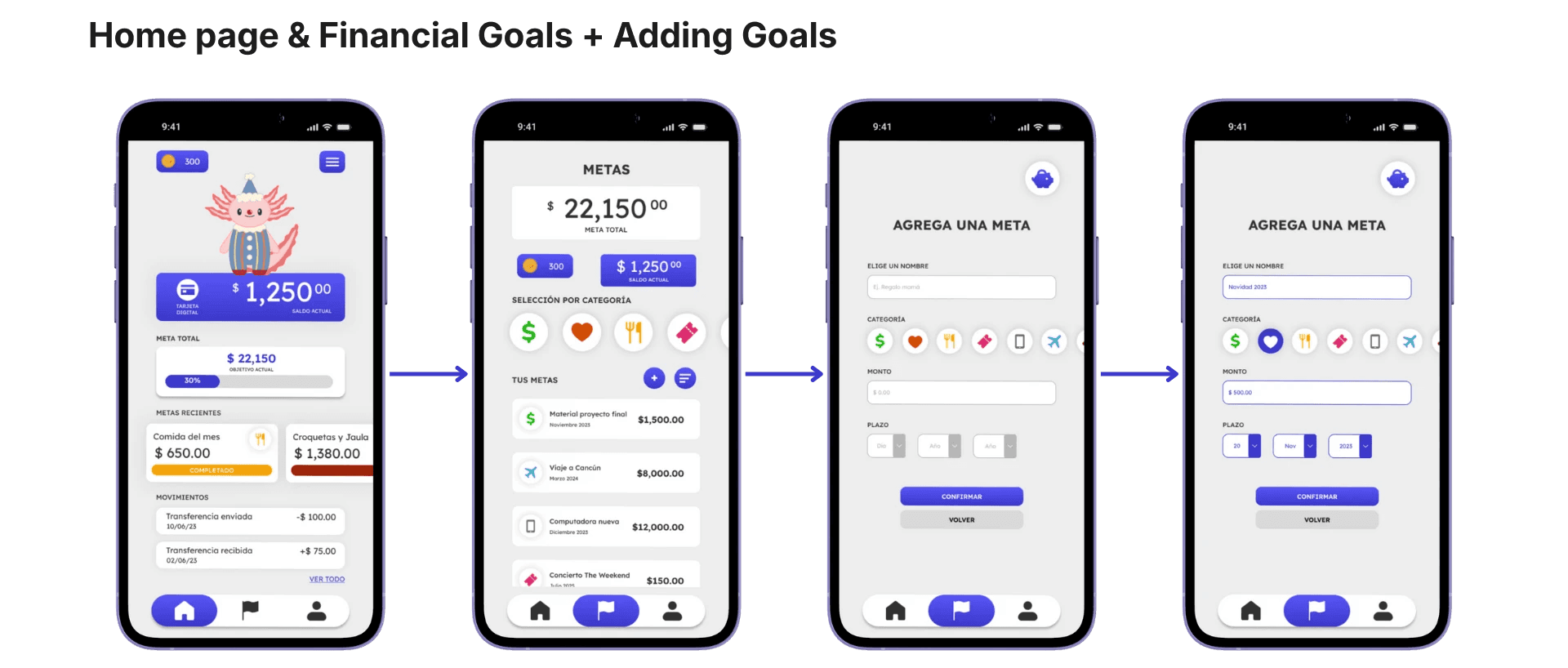

HIGH FIDELITY DESIGNS

HIGH FIDELITY DESIGNS

FIGMA FLOW PROTOTYPE

FIGMA FLOW PROTOTYPE

FIGMA FLOW PROTOTYPE

REFLECTIONS & ROOM FOR IMPROVEMENTS

REFLECTIONS & ROOM FOR IMPROVEMENTS

REFLECTIONS & ROOM FOR IMPROVEMENTS

Limited user testing:

Additional usability testing would help validate flows, emotional feedback, and clarity.Deeper personalization:

Future iterations could adapt Moyo’s behavior based on users’ saving and spending patterns.Financial guidance:

Subtle, contextual tips could support users’ financial literacy without overwhelming them.Long-term engagement:

More strategies are needed to sustain motivation and retention over time.

Limited user testing:

Additional usability testing would help validate flows, emotional feedback, and clarity.Deeper personalization:

Future iterations could adapt Moyo’s behavior based on users’ saving and spending patterns.Financial guidance:

Subtle, contextual tips could support users’ financial literacy without overwhelming them.Long-term engagement:

More strategies are needed to sustain motivation and retention over time.

Limited user testing:

Additional usability testing would help validate flows, emotional feedback, and clarity.Deeper personalization:

Future iterations could adapt Moyo’s behavior based on users’ saving and spending patterns.Financial guidance:

Subtle, contextual tips could support users’ financial literacy without overwhelming them.Long-term engagement:

More strategies are needed to sustain motivation and retention over time.